Strategies to Understanding the Property Owner Insurance Market for Discounts

As a concerned landlord, securing the best landlord insurance represents a critical step in protecting your investment. Given the challenges of the insurance market, numerous property owners search for cost-effective options and not compromising on insurance. Navigating the field of landlord insurance quotes may seem daunting, but armed with the right strategies, you can secure savings that enable you to save while ensuring your properties are sufficiently protected.

Understanding the nuances of landlord insurance is essential for any real estate investor. You require coverage that meets your particular needs, but you also don't want breaking the bank. By being aware of what to search for and how to engage with different providers, you will uncover opportunities for more affordable premiums and superior offers. In this article, we will discuss the strategies to finding the ideal landlord insurance quotes and optimizing the discounts available to you.

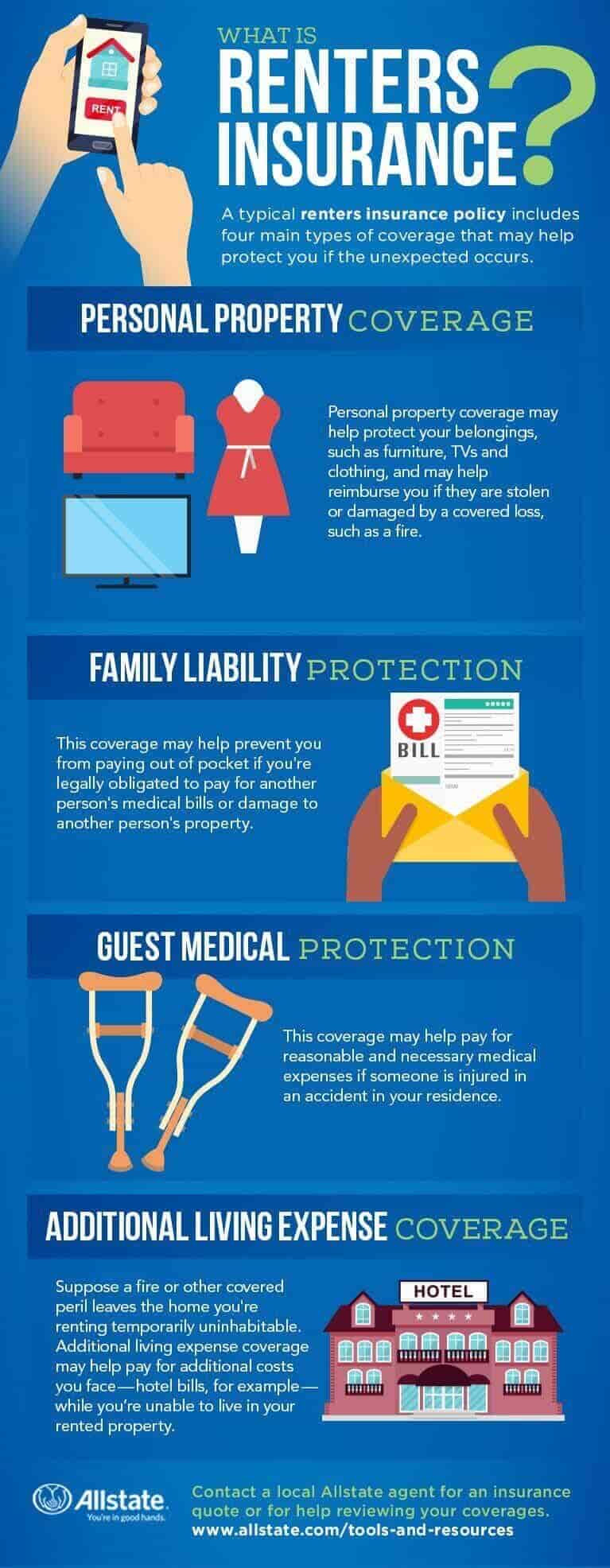

Understanding Rental Coverage

Rental insurance is a specialized type of coverage developed to shield property owners from possible risks linked to leasing their units. In contrast to standard homeowner's coverage, landlord insurance provides extra safeguards specifically designed for rental situations. This includes protection for losses to the building caused by lessees, liability protection in case a tenant or guest is hurt on the site, and loss of rental revenue resulting from unexpected events that may make the unit unlivable.

For landlords, grasping the details of this coverage can lead to substantial savings in insurance costs while also ensuring appropriate coverage. Insurance policies can differ widely, with differences in what is covered and to which extent. It is important for property owners to evaluate their specific needs, considering elements such as property characteristics, site, and vulnerability to pick the right insurance option that matches protection and expense.

Shopping around for rental property insurance quotes is essential to navigating this landscape successfully. Numerous insurance providers offer resources and material to evaluate insurance options and costs. By taking the time to gather multiple estimates, landlords can find the most cost-effective policies that still deliver comprehensive protection for their asset.

Comparing Proposals Efficiently

When seeking the best deals on landlord insurance estimates, it is essential to contrast policies from various providers. Begin by collecting at tips for getting the cheapest discount landlord insurance quotes to six proposals to ensure a wide range of options. Focus on the details of each policy, such as coverage limits, deductibles, and any exclusions that may apply. Understanding these details will enable you determine the policies that offer the best value for your needs.

Utilize online comparison tools and insurance brokers to simplify the process. These platforms can provide side-by-side evaluations of various landlord insurance estimates, showcasing key features and pricing. Moreover, be sure to check reviews and ratings for each insurer, as customer service and claims handling can considerably affect your experience if you need to submit a claim.

Finally, don't hesitate to reach out to insurance agents directly to discuss your needs and any possible discounts they might offer. Some providers may have unique promotions or discounts for combining policies or for having additional safety features in your rental units. Participating in direct conversations can also provide you more understanding into which insurer may be the best fit for you in the long run.

Tips for Securing Discounts

One of the most effective ways to secure discounts on landlord insurance quotes is to shop around and compare multiple providers. Different insurers have varying pricing models and discounts available, so obtaining several quotes can help you identify the most favorable offer. Be sure to compare not just the premiums but also the coverage options provided, making sure you understand what is covered and excluded in each policy.

Along with comparing quotes, it is beneficial to opt for increased deductibles. A higher deductible can significantly lower your premium, as you will be assuming more risk in the event of a claim. Assess your financial situation and determine a deductible that you can easily manage. This approach can lead to substantial savings on your insurance costs over time.

Finally, consider combining your landlord insurance with other types of insurance you may need, such as homeowners or auto insurance. Many insurance companies offer discounts for customers who purchase multiple policies together. Not only does this make easier your coverage, but it can also lead to significant savings on your total insurance expenditures.